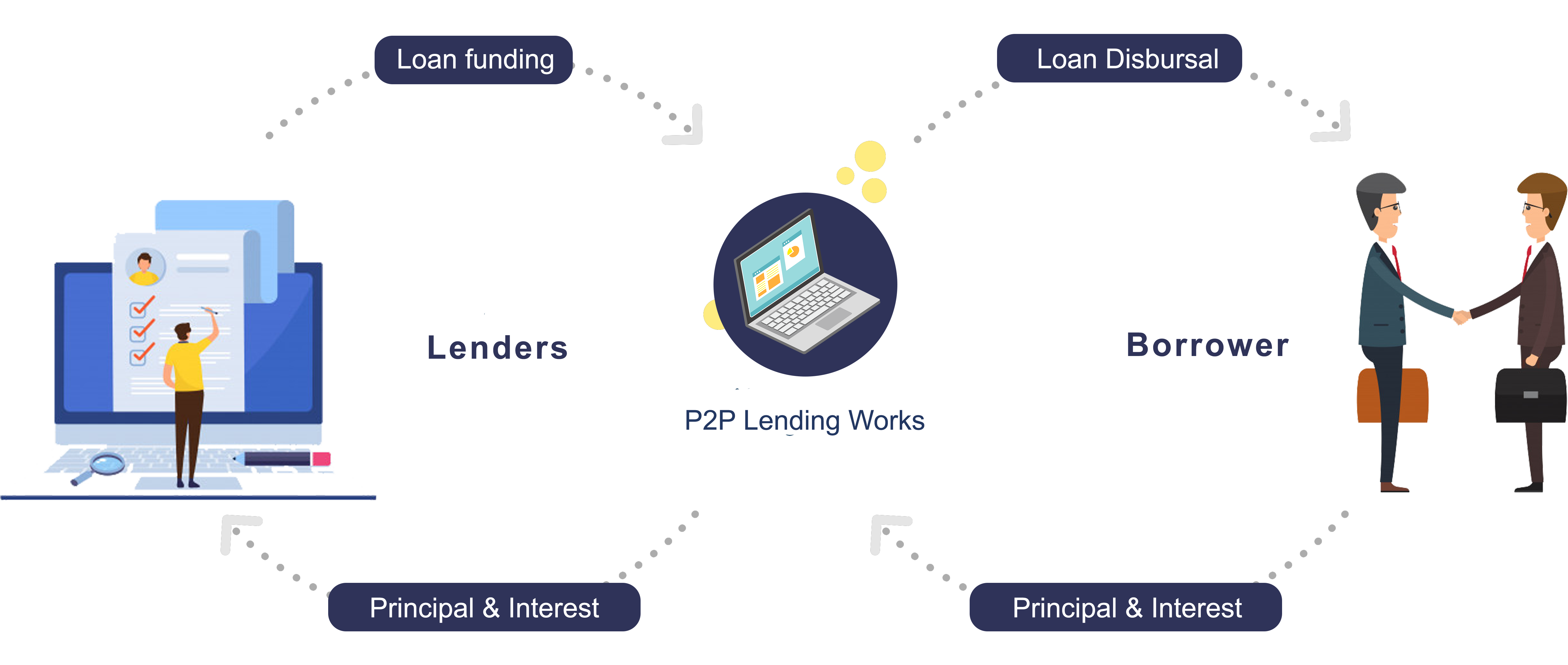

Lendtree is a Peer to Peer Lending (P2P Lending) marketplace wherein a creditworthy individual can borrow money for variety of purposes at a desired rate of interest and an investor (online money lender) can lend to retail borrowers at an interest rates which can be as high as 30% and for the FIRST TIME get an opportunity to earn high returns, earlier available to banks, NBFCs etc. For seamless operations, the entire loan funding process is digitized and is transparent, quick and easy.

Want a Borrowers?

- as Borrower

- Evaluation of Loan by Lendtree Application

- Loan Approval by lendtree & Interest Rate & Risk Category Asign

- Loan Amount Funded

- Physical Verification & Loan Agreement Signature

- Disbursal of Money Direct to Bank Account

- Repayment of Loan Through NACH to Escrow Account